Industrial Engineering #8 - Sara Gardner, Industrial IoT + Physical AI

Guest: Sara Gardner | Oracle, HP, Hitachi, Johnson Controls, GreyOrange

One of the many benefits of organizing events in San Francisco is the opportunity to connect with and learn from incredible industry experts. I first met Sara when she joined the Physical AI breakfast I organized for SF Tech Week, and we reconnected a few weeks later at RoboBusiness. Hearing Sara’s passion for robotics and other physical AI technologies, and her stories building products, leading commercialization, and supporting the growth of industrial robotics over the course of her career has been so fascinating and I’m sure her insights will be useful to other founders and operators in the industry. In this discussion, we covered the range of projects Sara has worked on over the years and key learnings from building each solution, where she sees the future of industrial automation, and actionable takeaways that founders can implement into their GTM and commercialization strategies today.

Thanks again for sharing your insights with us, Sara! Could you please share a bit about your background and path to robotics?

I have always been in tech. I completed my computer science degree back when very few women chose that field of study. I spent the first half of my career in traditional IT - databases, analytics, data center and cloud infrastructure - working for big tech companies such as Oracle, Ingres and Hewlett Packard. I first got involved in Industrial IoT and AI (which today fall under the umbrella of physical AI) at Hitachi around 2012. I immediately became hooked on the field and went on to co-found Hitachi’s first global IoT business, which became part of Vantara. I found the use cases way more fascinating than IT ones and inherently more impactful. GE coined the phrase “the power of 1%” back then to illustrate how the sheer scale of problems and systems in the industrial world meant that even the smallest improvements in efficiency could drive massive economic and societal impact, which is of course still true today.

Later in the decade, I joined Johnson Controls to help transform building security and safety with AI before moving into warehouse robotics at GreyOrange. At this point I’ve been lucky to have already worked on a lot of different facets of physical AI including robotics, edge devices, computer vision, digital twins, and a lot of industrial IoT. I am energized by all the amazing startups I am seeing in physical AI right now and am focused these days on tracking the trends and helping AI startups turn their technology into real commercial success.

How does the physical AI market today compare to what you experienced in the first wave of industrial IoT and intelligent systems?

Well they both have hype in common! 10 years ago, analysts were predicting the first wave to become a $3T market driving as much as $10T in economic impact by 2025, and that clearly hasn’t happened yet. So what did we get wrong and more importantly, what can we learn, because we are in a very different position now.

I think the tech vendors underestimated the market. They all dove into the new data goldrush expecting to sell quickly and discovered that the industrial companies in particular were very risk averse. The industrial companies had highly proprietary incumbent systems that weren’t built for open integration. They were not used to having their systems connected to the internet and yet many vendors at the time had entirely internet-based solutions, like GE Predix. That’s not to say there weren’t successes but it wasn’t the degree of wholesale transformation predicted. That first wave of physical solutions focused on data capture, insights and prediction, with use cases focused on specific tasks: asset tracking, failure prediction, and visual inspection. There were lots of pilots that somewhat stood as islands. We have come a long way in the past 10 years with cloud adoption, cybersecurity and edge technologies and of course AI, so many of the technology barriers have come down. We are frankly operating in a much more fertile environment for adoption now.

Are there any best practices you saw that led to success in the first wave that companies can adopt now?

Domain knowledge is important. One of the reasons we did relatively well at Hitachi was because of our domain knowledge as both a technology and industrial player; we made mining equipment, trains, automotive components, wind turbines and much more. When I look at startups today that’s the first thing I look at: how much real domain knowledge does that company have of the market they are targeting? Without really understanding the motivations of the customers you are targeting, their processes, the KPIs that matter, the systems that run their business, it’s difficult to establish credibility and trust and indeed solve their challenges in a really meaningful way.

Another key learning is making sure the economics for the use case exist. Warehouse robotics is a fabulous example of this. Retailers literally could not find enough people willing to pick in their warehouses. They had to provide free, fast shipping and returns in order to compete so they needed a solution that would enable them to move product faster, slash costs and dramatically improve delivery latency. There’s a reason why warehouse mobile robots are still the most dominant robots deployed. The market couldn’t function without them and when COVID hit and eCommerce exploded, the orders came flooding in even faster. On the other hand, I’m less bullish on fast food delivery robots. While they sound good in principle, the cost overheads are high in relation to the payload being delivered, their utilization is poor, and I think it’s fair to say humans are still a cheaper and more flexible option for delivery. I’m happy to be proved wrong on those delivery bots but finding markets where the need makes economic sense is key.

Where do you see this next wave of physical AI and robotics heading?

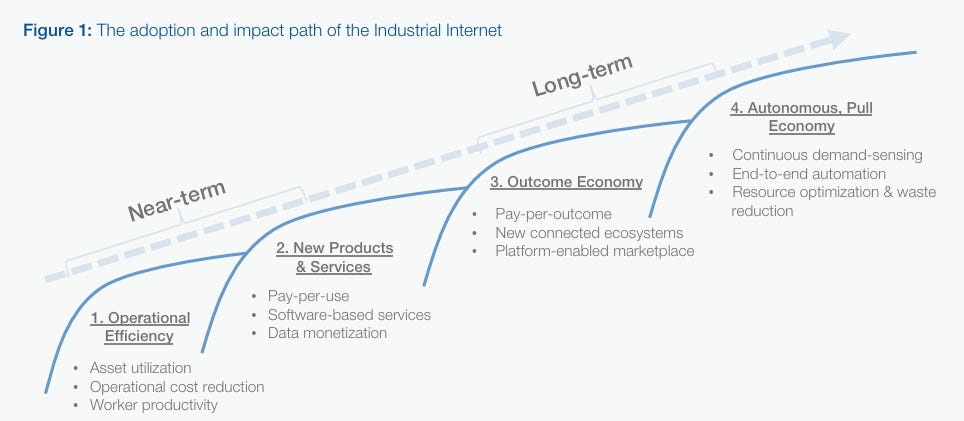

I like to think in terms of short and long term. To be honest, in the short term, I think you are going to see many of the same problems being tackled that we talked about 10 years ago. But now rather than point solutions, we will see highly integrated end-to-end processes that will deliver that transformation we didn’t get to fully realize the first time. Take predictive maintenance as an example. Rather than the outcome being a dashboard notification that a pump is about to fail that would then require human intervention, now in the physical AI era I expect to see end-to-end maintenance ecosystems with sensing, reasoning and action all orchestrated together. Think sensors and edge AI continually monitoring and interpreting signals from the pump and a digital twin putting those insights into context with baselines or past history. Then agentic AI systems can automatically create the work order if an issue needs to be addressed and trigger an inspection drone to send a visual from the field and so on. The point is highly autonomous systems that promise real business transformation.

Agentic AI also excites me because I know just how complex and gnarly some of those old legacy systems are and being able to use AI agents to simplify those workflows will be hugely valuable. If you don’t have to rip and replace all those systems but you have agents sitting in front with the ability to connect with other agents, you can get around the problem we had in the past where you built a point system over here and a point system over there. Agentic AI has the promise to really scale up deployments very, very quickly.

Obviously the real long term prize is AGI and humanoid robots able to learn and perform multiple tasks. I think we all agree that the technology is moving at an incredible pace but that we are still a long way from full commercial realization. Use case economics, robustness and reliability of the physical systems, maturity of the AI systems, and the availability of test data, safety and regulatory considerations are some pretty big hurdles still to get over. I remember attending panel discussions in 2014/2015 on autonomous cars and thinking their 7-year predictions sounded pretty aggressive and yet Waymo is very much a reality already. The pace at which we are moving right now is humbling.

With limited resources, how should startups decide to expand their target markets and use cases?

I have seen examples where the founders have really cool technology but aren’t able to express their market fit, which is a major miss in my mind. You need to start somewhere, ideally a vertical you have domain expertise in or can develop it. Some verticals like warehouse automation, are very large and can sustain focus and vertical expansion. In other instances, you might nail a use case in a niche market first and then expand horizontally. For example, at Hitachi we started with a lot of projects with our mining business because of a combination of domain expertise, need for maintenance solutions, and compelling cost benefits. Our data scientists honed their experience on those use cases and then were able to move horizontally to other larger markets with similar equipment profiles that needed maintenance solutions, of which there were many.

For startups selling into these industrial categories, are there specific sales channels or go-to-market strategies you’ve found to be most effective?

First, you need to understand who your buyer is. Who is making the decision? In warehousing, for example, it used to be the warehouse manager, or in security, the facility manager. But more recently, these purchasing decisions are becoming more strategic with business executives and IT involved. The point here is that depending on who the buyer is, they are going to have different metrics and outcomes they care about.

The warehouse manager cares about orders picked per hour, but further up the leadership chain, it might be about profit margins. Being able to express your value proposition in those terms rather than feeds and speeds is needed to excite prospects.

As a small company, being able to work with a larger partner can be a great go-to-market accelerator. Look at software companies providing a broader solution, like a warehouse management system if you are in the warehouse robot space or asset intelligence systems if you are looking at a maintenance solution or a systems integrator handling an entire modernization. Partnering can lead to exposure and larger players may be looking for compelling AI solutions to plug portfolio gaps and help them be relevant. They will likely already have booths at industry events, for example.

Also, make sure you aren’t ignoring vertical industry forums. Remember once you are clear on your buyer, “go where they are”, including events, LinkedIn groups, blogs, and publications. For example, I have had success ghost writing posts for industry experts on vertical forums.

What is one piece of advice you would give to a first-time founder building in this category?

In my experience, the area where founders need the most guidance is on the commercial side. Product innovation alone isn’t enough. If you don’t know who your buyers are or can’t express the value of your product in a way that resonates with them, then you are seriously hampering your chances of success.

Make sure you are clear on which market you are selling too and who the buyer is, as well as why they need your product and why you are better than the alternatives. It sounds simple but I don’t always hear a clear explanation when I ask those questions to startups.

Any final takeaways for readers?

There’s never been a more exciting time to be in Physical AI as we’re finally transforming years of research into real-world results, and few fields have the power to change the world quite so literally!

I’m eager to support the next generation of companies building and deploying physical AI solutions to solve real customer needs. If you’re an early-stage founder interested in battle testing your GTM strategy or you’re an industry operator trying to deploy physical AI solutions in your own operations, let’s connect on LinkedIn or reach out at sarajg123 [at] gmail [dot] com!

This series focuses on navigating technical software decisions within industrial companies. From optimizing infrastructure choices and leveraging DevOps best practices to harnessing the power of cloud technologies and improving data workflows, our guests will highlight how they’ve considered these decisions and implemented new solutions across their organization. If you’re similarly excited about leveraging technology to empower our national industrial base and/or building solutions focused on this category, please reach out. My email is ananya@schematicventures.com – I’d love to connect!